The new Construction Domestic Reverse Charge VAT is now effective (as at 1st March 2021) for the construction sector, meaning that invoices issued by construction companies have to account for, and show the accountability for VAT. At LWA have identified that the new tax codes aren’t automatically pulling through therefore please see a step-by-step guide below to ensure you are adhering to the new legislation.

Here’s what you need to do

If your business is affected by the new reverse charge rule and you use Xero to issue invoices, here’s what you need to do.

The new tax codes that are relevant to the reverse charge rule have to be added manually as currently they are not automatically pulling through into Xero.

To add these tax codes, take the following steps:

- log into Xero

- select Accounting

- select Advanced

- then select Tax Rates

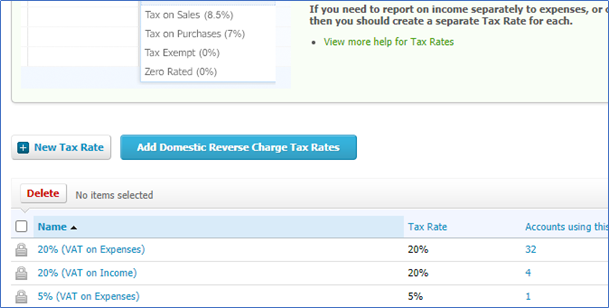

- You will then see an option to: Add Domestic Reverse Charge Tax Rates.

Please see the screenshot below.

How often do I need to do this?

You only have to add the tax codes by taking the steps above once. After this point, when creating an invoice or bill, you will have the option to select the correct tax code depending on whether the reverse charge applies for that invoice.

Further information

For further information from Xero on the Domestic Reverse Charge VAT including useful downloadable guides, please click here.

You can also find all of our blogs relating to the Domestic Reverse Charge VAT in our dedicated Construction & Property section of our website.

Please contact our in-house Xero & Dext (formerly Receipt Bank) expert, Bradley Allen-McKenna for any queries, or if you’d like to learn more about how we can support your business with accounting software, call 0161 905 1801 in Manchester or 01925 830 830 in Warrington. You can also email Bradley direct at Bradley@lwaltd.com.