Basic information

The government’s 80% pay reimbursement (Furloughed Worker Status) for employees

The Chancellor announced on 20 March, that the Government plans to reimburse 80% of employees’ gross wages subject to a £2,500 maximum per month, to their employers. The scheme is designed to support employers whose operations have been severely affected by coronavirus (COVID-19). The Government has said the scheme will take retrospective effect from 1 March, and will last for a period of three months. We read this as meaning the scheme will end on 30 June 2020, unless the Government extends it. The Government website currently suggests the payment part of the scheme will be ‘up and running’ by the end of April, and the plan that employers will register employees as Furloughed Workers on an HMRC portal. Following some kind of process, payments should be made direct to employers’ bank accounts.

Who is included

- Full time employees

- Part time employees

- Employees on agency contacts

- Employees on flexible or zero-hours contracts

- Employees on maternity leave, receiving contractual adoption pay, paternity pay or shared parental pay

- Employees made redundant after 28 February 2020 if they are rehired by their employer

- You cannot include

- employees who commenced employment after 28 February 2020

- employees who are working on reduced hours, or for reduced pay

- there are separate rules for the self-employed – please contact us for further details

Remember that you have to decide who is eligible to be placed on Furloughed Worker Status, the employee cannot demand it of you. Please seek guidance before deciding who to place on Furloughed Worker Status, as the usual discrimination, breach of contract and unfair dismissal rights apply.

What is included

- 80% of normal pay, excluding commission or bonus payments, to a maximum of £2,500 per month

- National Insurance and Auto Enrolment Pension contributions on that 80% (pension contributions relate to the minimum statutory payments under auto enrolment)

- Statutory Maternity Pay, contractual adoption, paternity or shared parental pay – we are assuming that you will have to pay 100% of the maternity pay due to the employee, then try to reclaim 80% of that, but this is not yet clear.

How to calculate pay (what you can claim)

- For full and part time salaried employees, the employee’s actual salary before tax as at 28 February 2020, excluding commission and bonuses

- For employees whose pay varies, if the employee has been employed by you for a full 12 months prior to the start of the Furlough period, employers can claim

- The same month’s earnings from the previous year OR

- Average monthly earnings for the 2019-20 tax year

- For employees whose pay is variable, and who have less than 12 months’ continuous employment, you should claim based on the average of their monthly earnings since they started work.

Important dates

- 28 February 2020 – the date upon which you must have had a PAYE scheme running for your employees

- 1 March 2020 – the earliest date to which you can backdate claims for reimbursement subject to certain rules

- 30 June 2020 – the assumed end date of the scheme unless the Government extends this

Further details

- Furloughed employees cannot undertake work for their employers during their Furlough period

- Furlough periods must be a minimum of 3 consecutive weeks long.

- Employers are permitted to reduce an employee’s pay under the scheme (with the employee’s agreement) to 80% even if this places the employee below the National Living Wage or National Minimum Wage

However, some details are unclear – we do not yet know

- How to calculate the National Insurance and Auto Enrolment pension contributions to be reimbursed under the scheme

- What the rules and amounts are in relation to maternity pay, adoption, paternity or shared parental leave

- What the HMRC portal will look like, or the detailed process of making a claim

We must assume that holiday accrues as normal during a period of Furlough leave, as although the Government have not yet made that clear in their guidance, the employee remains employed during the Furlough period and should retain their statutory and contractual rights for that period, excepting pay as agreed.

Sick leave or self isolation

Whether an employee is told to self isolate by a medical professional, or chooses to do so as a result of concerns over their own health, or that of a person close to them or at home, you should pay them SSP. The Government has announced SSP is payable from day one of sickness now and that there will be a reimbursement for small businesses of up to 14 days’ SSP.

When someone’s sick leave ends, you can take advantage of the 80% pay reimbursement by placing them on Furlough leave, but this will still need to be with their agreement.

If someone is within a vulnerable group and chooses to self isolate for the 12 week period currently recommended, you will need to ask us for specific advice on a case by case basis. Just because a person is off sick, or self isolating does not currently protect them from redundancy, but this may change at very short notice in the current climate.

As schools are closed

If your employee cannot come to work because their child’s school is closed, they will effectively be on unpaid leave – either time off for dependents or some form of unpaid parental leave. You could place the employee on Furlough status once the unpaid leave has ended, but you should take each case on its merits and seek specific advice.

Redundancy

Redundancy occurs where there is a lack of work, or as the law puts it ‘the diminution or cessation of work of a particular kind or in a particular place’. Redundancy can occur where businesses are short of work or where they have to shut down completely. If staff have more than two years’ continuous service with their employer, they are entitled to redundancy pay along with any contractual notice and, they have the right not to be unfairly dismissed. If they have less than two years’ service, you still have to give or pay notice, but there is no right to statutory redundancy pay.

Automatic redundancy

If you were to lay off an employee or reduce them to short time working of less than 50% of their normal hours or pay, for either a) four consecutive weeks or b) for six weeks in any 13 week period, they would be able to claim a redundancy payment from you. If one of your employees asks for this, contact us immediately. However, if they have less than two years’ service, they would not be entitled to a redundancy payment. If they are over two years’ service, they would need to write to you to claim the payment.

Lay off and short time working

Lay off is where you have no work for an employee and you ‘lay them off’ for a period of time, asking them not to attend work but to remain available for work, should you need to call them back in. They remain an employee and they still continue to accrue holiday as if they were working. Short time working is where an employee works less than their normal contracted hours as there is insufficient work. Lay off and short time working are nearly always used as alternatives to redundancy.

In the contract or by agreement

You can only use lay off or short time working where an employee’s contract specifically gives you the right to do so. An unsigned contract does not count, nor does putting the lay off or short time working clauses into a policy or handbook, unless the policy or handbook is contractually bound – which needs to be determined on a case by case basis.

If there is no such clause in the contract, and no collective agreement with trade unions, you must have the employee’s agreement to lay them off or put them on short time working including Furlough leave. If the employee agrees, you must obtain that agreement on a variation of contract letter, which we can draft for you.

Pay during lay off or short time working

Employees who are laid off other than on Furloughed Worker Status, or put onto short time working will not get their normal pay unless you call them back into work. If an employee is laid off, or where short time working is less than 50% of their normal working hours, they are entitled to

statutory guarantee pay. This is paid by you as their employer at the rate of £29 per day, for a maximum of five days in any three month period. If the employee is placed on Furloughed Worker Status, they will receive 80% of their pay under the scheme described above, unless you wish to top up their pay beyond the 80% at your own cost.

Working from home

You could choose to agree with your employees that they work from home. If you do so, bear in mind

- The change in the place of work is a variation to their contract which should be agreed

- Consider confirming the change by way of a specifically worded letter or policy

- You are still responsible for aspects of their health and safety at work: risk assessments, display screen equipment and workstation

- GDPR and Data Protection can present challenges with homeworking and you should review your existing arrangements to ensure applicability to homeworking

- Employee productivity and wellbeing can be adversely effected by working from home

- The longer an employee remains away from their workplace, the more likely it is they will become disengaged from the business – keeping in touch is vital.

Planning what to do

Assess your workforce carefully, checking their original start dates, if they have signed contracts and if so, what does their contract say about lay off or short time working.

You should bear in mind that the reduction in pay to 80%, as per above, will not change the fundamental issue that it is a reduction in pay, which should be discussed and agreed with your employees, then documented as per any other temporary change in contractual terms.

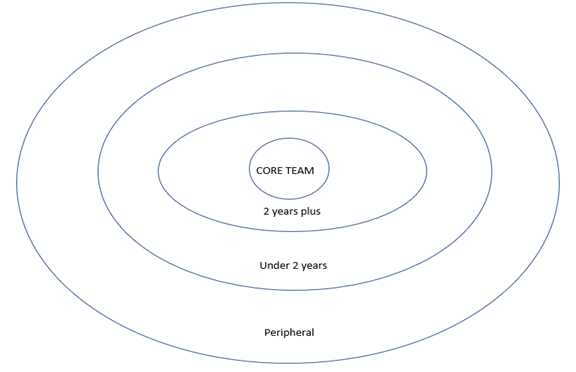

You could consider dividing up your staff into groups, which will help you to see which actions might have the greatest risk in terms of employment and pay. You will obviously have to identify your core team first – the people whom you most need to retain. Thereafter, you could divide your staff up as per the diagram below:

Core team workers are likely to be on full or part time, permanent contracts or fixed term contracts. The 2 year plus group will be on similar contracts, and will have more than two

years’ service, but be less business critical than the core team. The under 2 years group will be the same as the 2 year plus group, but will have less than two years’ continuous service. Finally, the peripheral group will be zero hours workers, casual labour, agency staff and possibly sub contractors, if you have any.

Specific advice

The start point has to be a consideration of your cash flow situation, and examination of any reserves available to you. Business rates relief, landlord goodwill, mortgage holidays etc may be possible, but we advise you to be as cautious as possible when assessment the business’ financial situation.

You should potentially have two plans for your business – the first in the event you are able to continue trading at some level, and the second if lockdown is ordered across England.

It is never too early to discuss matters with your staff, even if you are not sure the exact details of what will happen, or when. We can help you with a short script if that would assist.

The overarching discrimination legislation is still in place, so whatever action you take, you should ensure you do not accidentally discriminate against protected groups – those on fixed term contracts, part time workers, differing genders/ages/ethnicity etc. I would urge you to take specific advice relevant to your circumstances.

For further advice and to discuss your options, please call me on my mobile 07702 886 726. I am available seven days a week during the current challenging period.

Wishing you well during these difficult times.

Alix Passey Brown

Chartered FCIPD, MSc, MA, DPM

Director, Twyford HR Ltd