National Insurance Contributions (NICs) rates and annual thresholds

The Chancellor announced a package of changes to employers’ Class 1 NICs that will apply from 6th April 2025:

- An increase in the employers’ NICs rate, from 13.8% to 15%;

- A decrease to the threshold at which an employer starts to pay NICs on each employee’s salary (the ‘secondary threshold’) from £9,100 to £5,000*; and

- A widening of availability and an increase in the amount of the ‘employment allowance’, which eligible employers can offset against their employers’ Class 1 NICs liability, from £5,000 to £10,500. In particular, the employment allowance has only been available to businesses who have incurred an employers’ Class 1 NICs liability of less than £100,000 in the previous tax year but that restriction will be removed for 2025/26.

* A higher secondary threshold of £50,270 applies for employees who are under 21 and apprentices under 25. Other variations can also apply.

This increase in employers’ NICs is undoubtedly a blow to some businesses and, indirectly, employees. Combined with the increases in the NMW and potential costs associated with reforms in employment law, these measures will stretch employer wage budgets and potentially lead to slower growth in some employee wages or higher costs for consumers.

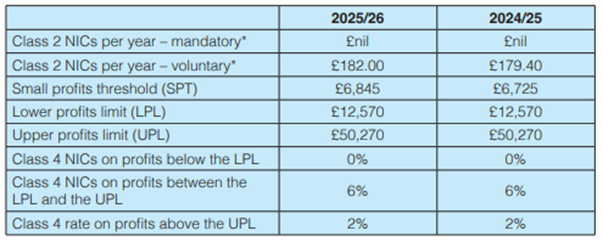

National Insurance for the self-employed

Self-employed individuals pay Class 2 and Class 4 National Insurance Contributions (NICs). The relevant rates and thresholds are:

* From 2024/25 onwards, Class 2 NICs are effectively abolished. If trade profits exceed the SPT, the individual will accrue entitlement to state benefits such as the state pension.

However, if trade profits fall below the SPT, the individual will need to pay Class 2 NICs voluntarily if they need the tax year to qualify for state benefit purposes.

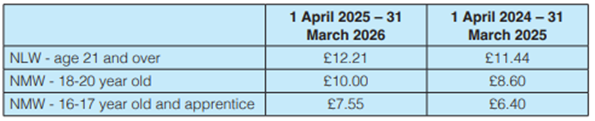

National Living Wage (NLW) And National Minimum Wage (NMW)

Employers must pay their employees at least the NLW, for workers aged 21 and over, or the NMW otherwise. The minimum hourly rates change on 1 April each year and depend on the worker’s age and if they are an apprentice.

The percentage increases for the 18-20 year old rate (16.3%) and the 16-17 year old and apprentice rate (18.0%) are significant. This is a step towards Labour’s ambitions for all adults to receive the same minimum wage. While this is good news for workers, employers will need to carefully consider affordability when planning their headcount for the year ahead.

Inheritance Tax for farmers and business owners

The government is proposing to reform IHT agricultural property relief (APR) and business property relief (BPR) from 6th April 2026. Relief of up to 100% is currently available on qualifying business and agricultural assets with no financial limit.

From 6 April 2026, it is proposed that 100% relief will only apply to the first £1 million of combined agricultural and business property, with the relief reducing to 50% on the value that exceeds £1 million. This means the relief will be focused on small family farms and businesses.

In a further proposed change, the rate of BPR available for shares designated as “not listed” on the markets of recognised stock exchanges, such as AIM, will be reduced from 100% to 50%.

As an anti-forestalling measure, the new rules will apply to lifetime transfers made on or after 30th October 2024 if the donor dies on or after 6th April 2026.

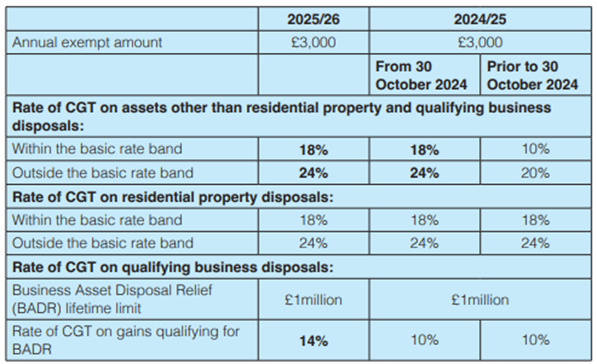

Capital Gains Tax for entrepreneurs

As expected, and with immediate effect from the budget date of 30th October 2024, the rates of capital gains tax (CGT) have been increased on some asset types as follows:

Entrepreneurs will be pleased to learn that Business Asset Disposal Relief (BADR) will continue to apply when they dispose of their business. However, the rate of CGT on BADR qualifying disposals is increasing from 10% to 14% for disposals made on or after 6th April 2025, and from 14% to 18% for disposals made on or after 6th April 2026. These rates apply to the first £1 million of qualifying disposals.

LWA are here to help you

You can view our full Budget Summary and Tax Guide here:lwaltd.com/resources/2024-autumn-budget-summary

If you need bespoke advice on any aspect of the Chancellor’s Autumn Budget 2024, or have any other corporate or personal tax issues you would like to discuss, please contact a member of our team – we’re here to help. Call 0161 905 1801 in our South Manchester office or 01925 830 830 in Warrington, or you can email us via mail@lwaltd.com.